The April edition of Eye on ESI was a fast-paced look at what’s happening in the ediscovery industry’s current job market. As the job market continues to stall for full-time opportunities, the panel discussed the many new trends seen, offered predictions, and gave advice to both job seekers and hiring managers.

At the end of the first quarter of 2023, the team discussed data that illustrates what is going on in the minds of job seekers and hiring managers. TRU Staffing Partners has been tracking this data since before the pandemic. The recent research shows:

- There are fewer open jobs now than at the end of Q1 of 2022, but competition over talent is just as strong.

- 95% of job seekers are accepting offers when they’re extended. This is a huge change from last year when job seekers were taking counteroffers or waiting to get multiple offers before they decided to take a job. The stat shows that job seekers are serious about moving when they get an offer.

- 100% of first round interviews are virtual. This is the new normal. First-round interviewing will always be done by video. it is now critical to a job search to be good on camera.

- 80% of job requisitions are filled with the first wave of interviewed candidates. This means that employers are being more deliberate and decisive with their hiring practices. They want to see fewer, more targeted resumes. They don’t want to interview multitudes of candidates. They want the process to be streamlined and efficient.

- TRU talent agents are seeing salaries stay high, and that is consistent with Q2. Salaries are not coming down, meaning that the rate of hire in terms of dollars and cents isn’t dropping based on market conditions.

- Fewer than 10% of job seekers are getting counteroffers when they resign. Employers need to find ways to cut headcount to add money back into their budget or to allocate those resources elsewhere. So, if you’re using your job search as leverage to get a counteroffer in this environment, you might be disappointed when you resign.

- The motivations for changing jobs have shifted. Job seekers are looking for very precise options.

- Contractors are more popular than they were last year. Ediscovery hiring managers are pros when it comes to using contractors efficiently, and the job market shows a surge in hiring these workers.

- Law firms have taken over much of the hiring in the industry. In the past, vendors and consulting firms have ruled the hiring roost.

Ediscovery Industry is Strong but Uncertainty Lurks

The stock market doesn’t indicate that we’re in a recession but many employers fear inflation if they are debt-leveraged and are reacting to Big Tech layoffs. What we’re in is a state of uncertainty. And that state of uncertainty changes the behavior of the job seeker and the hiring manager. Competition has been so fierce now post-pandemic that tenure is the last thing that the hiring managers really care about. They are looking for strong Relativity skills, having previous law firm experience, having previous vendor experience, having great soft skills, being able to consult as well as process data, and using the most advanced technology.

Prediction: The Job Market Will Shift Next Year

In Q2 of 2024, expect that the job market will swing back to full-time hiring. The industry needs two quarters back to back where Big Tech has high profits.

If stock prices go up, then they’re going to start hiring full time again. That doesn’t mean jobs are going to become available. It’s just the social cues that the rest of the world is taking in terms of the temperature of recession or non-recession. Big Tech is a good indicator of what the rest of the economy will probably do. The NASDAQ is up 25% in three months, and that means money in the coffers of those people. Once they have two quarters of profitable earnings reporting, watch for the culture of full-time hiring to accelerate aggressively.

Right now, contract hiring in Q1 has been fierce in ediscovery. A good indication of uncertainty is seeing contract numbers go through the roof. Per previous predictions, contract work is currently 60% of TRU’s business.

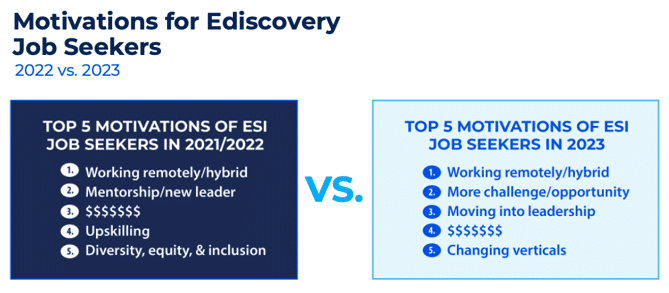

Motivations Change for Job Seekers

TRU operations staff tracks motivations very closely to understand why people change jobs. Here is what they have discovered over a year’s time:

In Q1 of this year, things really shifted. While the number one reason for changing jobs remains the desire for remote or hybrid work, it’s a determined stance. That’s the one thing job seekers are not willing to compromise on. Mentorship and new leadership was number two last year. It’s now dropped to number three. What wasn’t even on the chart last year, which is now number two, is to obtain a more challenging opportunity.

Ediscovery pros feel like they hit a ceiling in terms of earning potential and growth opportunities. The third reason on the slide is an important one because this is where the industry is having friction. There just aren’t enough leadership jobs available for all the people that want to move into some kind of leadership role. If you’re looking for how to motivate a PM, help them understand what’s next, not just that they’re going to do the same job every day. Know that people have made a lot of money in the last few years, so that seems to be less important than other things.

Unfortunately, diversity and inclusion are just not coming up in conversations right now. Changing verticals is a primary motivator, but people who come to TRU with that motivator don’t ultimately take a job where they change verticals. They want to take a job in the space for other reasons.

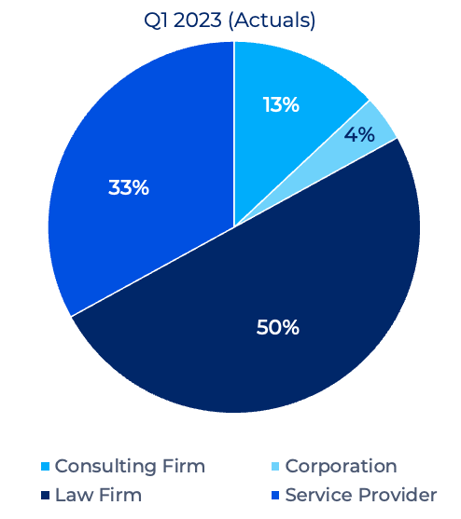

Jobs by Employer Type for ESI

This is a new statistic for Q1 only, but this is who accepted offers in the first quarter:

Law firms have taken over 50% of the marketplace. This is a huge change from the past. Vendors and consulting firms usually have about 65% of the open jobs that are accepted in the industry. This change happened because so many law firms are now hiring. Service providers tend to show the greatest reluctance to spend money on headcount. Corporations have pulled back as well, which is why they’re only 4%.

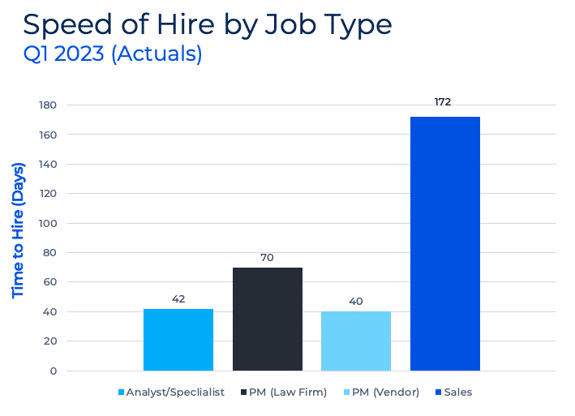

Law firms struggled to fill jobs in the fourth quarter because they were forcing people back into the office. Job seekers weren’t willing to come back into the office. Those jobs all got filled in Q1. Also, law firms are getting faster at making decisions. They’re being more deliberate so they’re getting more acceptances. See the speed of hire chart: law firm jobs for PMs have sped up. It used to be 120 days. It’s now 70:

For all others, the timelines are noted below. They’re similar to Q2, except for law firm PMs. Notably, it’s about seven days for contractors. There’s still a high demand for contractors and plenty of opportunity.

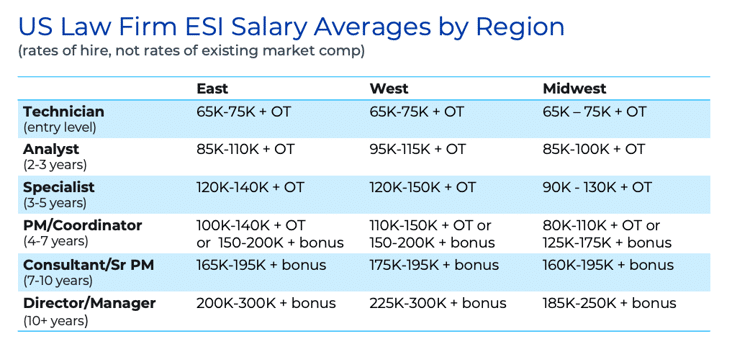

Salaries are Holding Firm as Expectations Stay High

Salaries haven’t changed since last quarter. The chart below shows that these are the new normal in terms of salary and PM salaries. They have gone up almost 40% from 2020:

Roles for client service manager, client service director, analytics overlay, and senior PM team lead are starting to come open on the market, which is also a sign that certainty is coming because they’re looking to put in net-new leadership roles that didn’t exist before.

Contractors Are Getting ESI Work Done

Contractors are being hired to do open project work across the industry. These include project managers, data processors, legal, data process, and database analysts. Employers may need a PM for a week, or they don’t want to do reporting at the end of the year, or the candidate doesn’t want to work full time. Contractors bill what they bill, and the employer can project how much profit can be made with that individual. TRU is seeing more people want to go into the gig economy – it’s about the flexibility they get.

Workplace Evolution Shows Motivation of Job Seekers

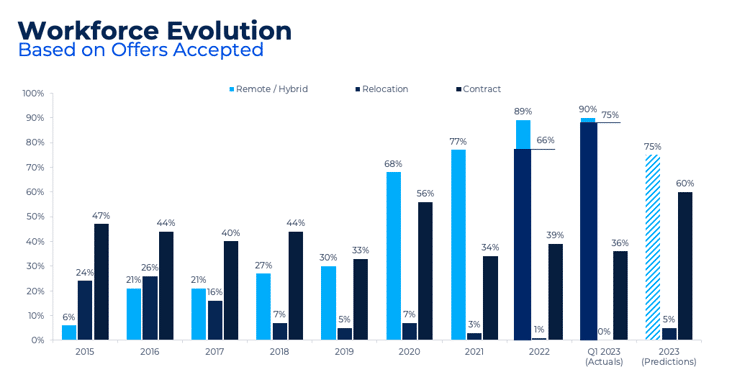

In 2022, 89% of roles were hybrid, which means spending three days a week or fewer in an office. Then, 66% of those were 100% remote. In Q1 of 2023, 90% were three days a week or fewer hybrid or fully remote, and 75% of those 90% were 100% remote. If an organization is 100% remote, open jobs are getting filled faster, more candidates are interested, it also means there is more competition and hiring moves quickly.

While the job market waits for the dust around the economy to stabilize, there are many opportunities to consider if you are thinking of entering the job market. Be sure to check out the TRU Staffing Partners job board to see if you can find your next new role. If you’re looking to get ediscovery work done and need an extra pair of hands, request TRU talent.