Every monthly Eye on ESI webinar I host with ACEDS President Mike Quartararo, and ACEDS VP, Strategy & Client Engagement Maribel Rivera delivers key industry hiring metrics from the previous month. We show job seekers and hiring managers what’s happening in the ediscovery job market. While the numbers didn’t change much from last month, the middle of Q1 2023 showed much potential for an explosive market later this year.

Vendors and Law Firms Differ on Speed of Hire

We’ve been tracking these core metrics for quite some time now, the first of which is speed of hire.

Q4 of last year and Q1 of this year have been very similar in terms of how long it is taking employers to hire new talent. It takes most vendors hiring mid-market professionals around 25 to 35 days from start to finish, and law firms hiring similar professionals around 90 to 120 days. The longer time for law firms is attributed to their common in-office requirements. Most candidates prefer remote work or limited time in an office.

Contract staffing has sped up because most of the jobs out there have shifted modalities into contract or contract-to-hire versus full-time. People are feeling uncertain about the job market due to news about mass Big Tech layoffs, and candidates are preparing for a recession and won’t make moves.

However, I think we are going to have a soft landing rather than a recession. But that may mean some of the job market has to get worse before it gets better. By the time Q2 starts, you will see a lot more jobs flood onto the market. Most jobs will still be contract based, but there will be more full-time jobs as well. Most of these full-time jobs will be mid-market positions and the speed of hire won’t change. The new normal for speed of hire will be:

- 30 to 40 days for vendors

- About 90 days for law firms

- A couple of weeks for contractors, and

- Fewer than three months for executives

This is because if you don’t make an offer to a candidate in ediscovery, in this timeline, someone else will. The other thing that hasn’t changed is how many offers a candidate is getting when they go to market: Fewer folks are willing to change jobs at this time, and as a result, the market remains competitive.

Hiring is still moving at a good clip. Pre-pandemic hiring was three to six months for executives. It would sometimes take two to three months just to get through first contact interviews where four or five stakeholders wanted to meet candidates in person. That process would take three months and then another two to three months to actually close in on a candidate. Now, it’s three to six weeks. It’s a bit longer right now because jobseekers don’t want to make moves. They’re a lot less willing to throw their hats in the ring and much pickier about what they’re looking at than they were six months ago.

TRU talent agents are seeing many more jobseekers who are reaching out for new roles. What we’re experiencing from job seekers is a real reckoning on company culture – mission, people, in-office mandates, and other intangibles. We hear it from one out of every three people who are seeking new roles. People need different kinds of flexibility. They need to know the purpose behind rules and how companies structure their businesses.

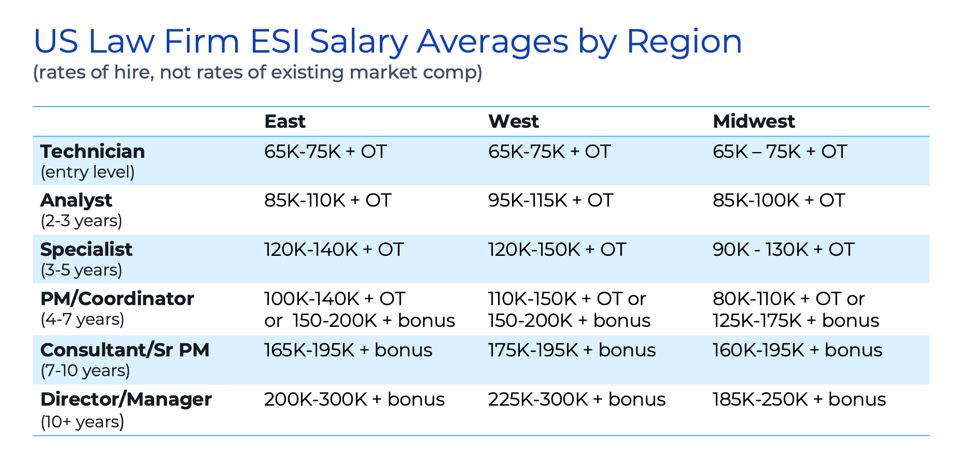

New Salary Averages by Region

Here are the salary numbers for law firms:

The Consultant/Sr. PM line is where most of the market is hiring at law firms right now. We’re starting to see this as the new norm, which is about 40% higher than 2019. Most of those jobs in law firms require an in-office presence. However, candidates are not going to come into an office without more money.

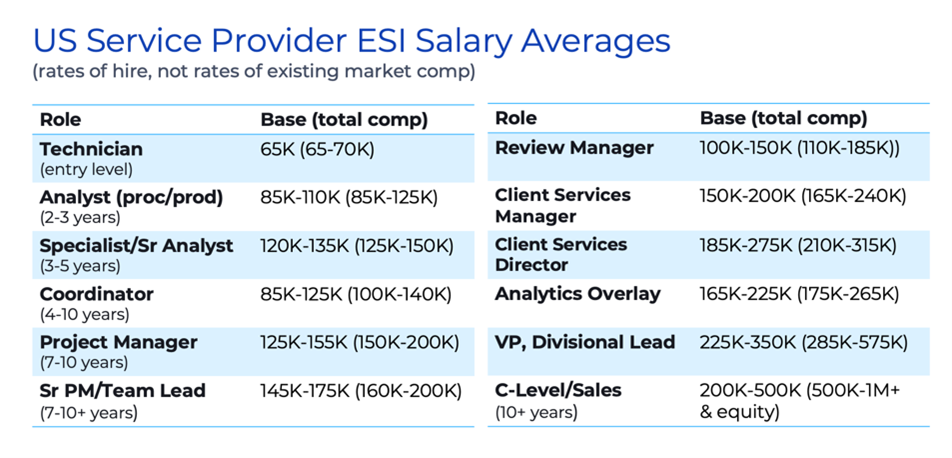

Here we have vendors’ salaries. They’re broken down with a little more specificity because the ecosystem there is a little broader.

The difference between analysts at a law firm versus a vendor is that law firm analysts are still involved with cases in meaningful ways. Analysts at a vendor are like paratroopers. They parachute in, add value, then move out. But we are starting to see that pick up a little bit. There is very little movement at the upper middle management level anywhere in the market right now. However, there is a lot of movement in the middle and at the bottom. We’ve seen more hiring at the bottom tiers in the last two months than we have in the last two years.

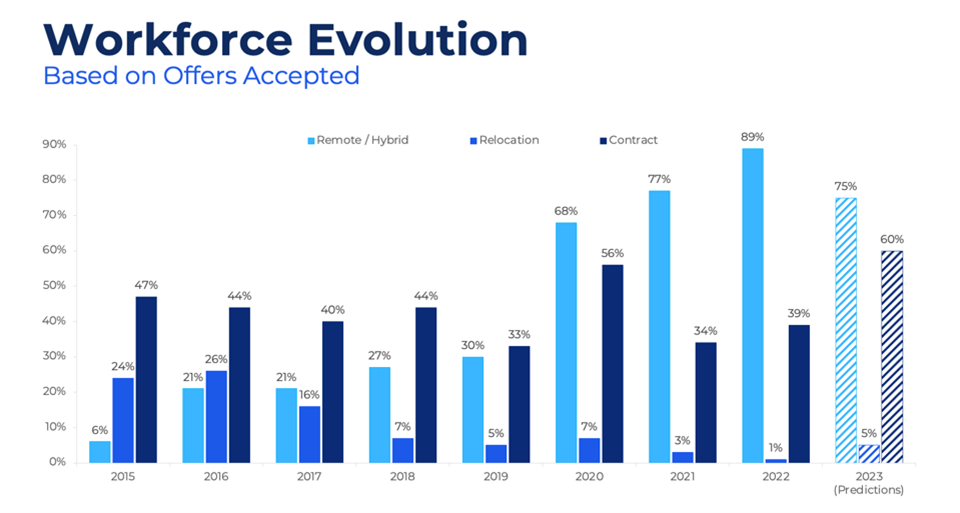

Workplace Evolution Shows Law Firms Leaning on Office Presence

While we didn’t get to discuss workplace evolution in this month’s webinar, the slide above bears repeating. TRU is still seeing a very high percentage of remote roles and contract work. We anticipate some slight increase in relocations because law firms will have to relocate people to fulfill roles that have an in-office mandate.

The breakdown of TRU placements works as follows: 80% of the jobs in this industry are at vendors and consulting firms and software companies, and the other 20% are at law firms with sprinklings at corporations, depending on the year. Note that we don’t track ediscovery jobs in corporations. They don’t exist, and when they do, they are generally far left-leaning in forensic collection investigation and are low level. Corporate roles always pay less than what a law firm or vendor will pay. Corporate America is not in the business of running expensive ediscovery departments despite how much cost savings they might provide the organization.

My advice is if you want work at a big corporation, reinvent yourself into a cybersecurity, data privacy, or governance professional because that’s where the jobs are in Big Corporate. There are exceptions to that rule, but they’re few and far between.

Looking Forward in Ediscovery

I think it’s going to be a great year ahead. The NASDAQ is up 12% in four weeks. Tech companies are coming back with a vengeance. Lots of CEOs made many hard decisions. All laid-off people are going to land on their feet. Most of them have the time to be patient to land at the right place, but people are looking right now. They may not be hiring as quickly as they were in the past, but everybody’s still shopping right now.