12/4/2024: Keep Multiple Versions of Folder Contents with Windows File History Tool

Don’t miss how easy it is to have Windows keep backups of folder contents, so you can always access the set of files that you had in a folder yesterday, a week ago, last year, or even 10 minutes ago.

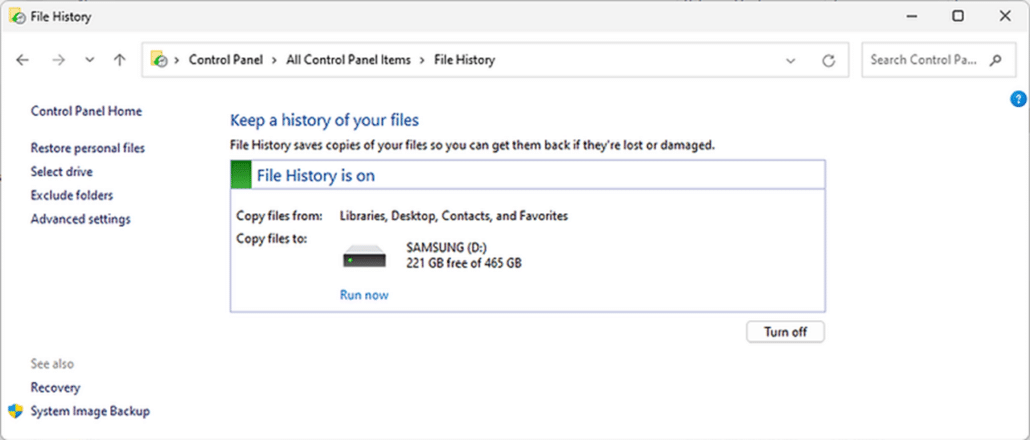

In Windows 11, simply search for and open File History:

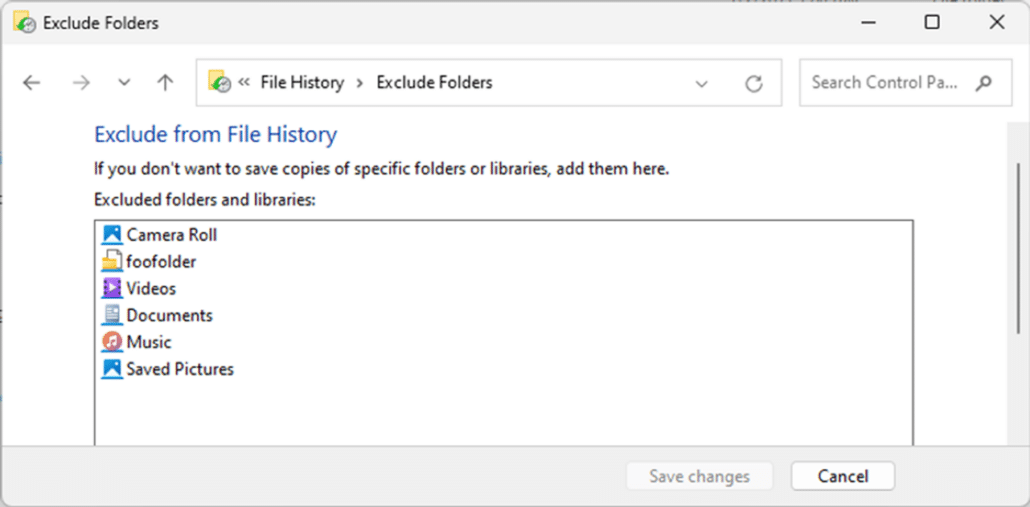

Select a location on your network, or on an external hard drive. Note that while File History will be set to back up files automatically at different intervals, you have the option to initiate a backup by clicking ‘Run now’. You can exclude certain directories from the backup process.

You can set files to be backed up at 10, 15, 20, 30, and 60 minute intervals, or every 3, 6, 12, 24 hours. Windows can keep the backups for 3, 6, 9, 12, or 24 months, indefinitely, or until you run out of network space.

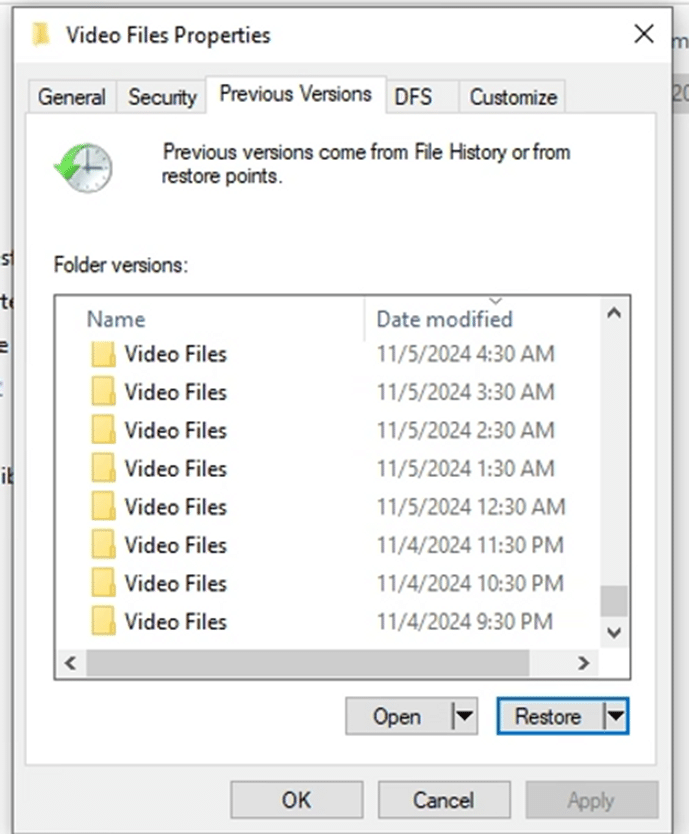

You can access the backups by selecting properties for a folder and looking under the ‘Previous Versions’ tab.

If you are using the home edition of Windows, it may not be possible to access the backups.

12/16/2024: Using VMware on Your iPhone

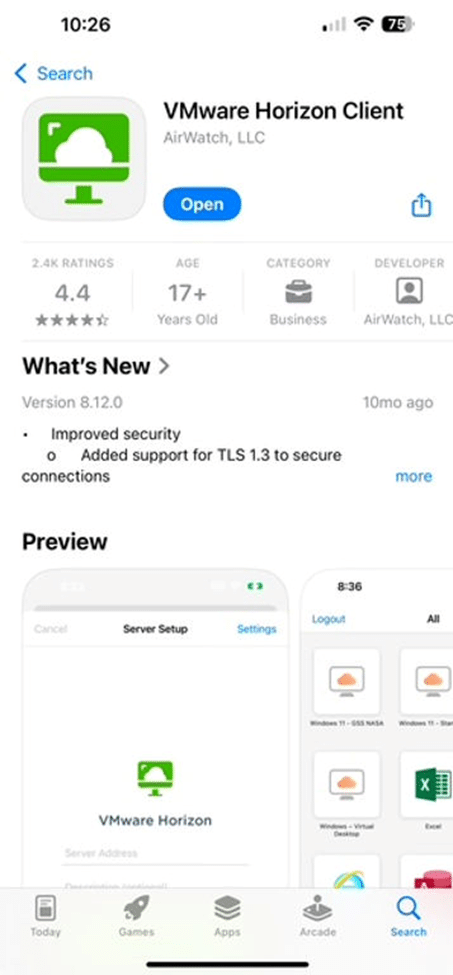

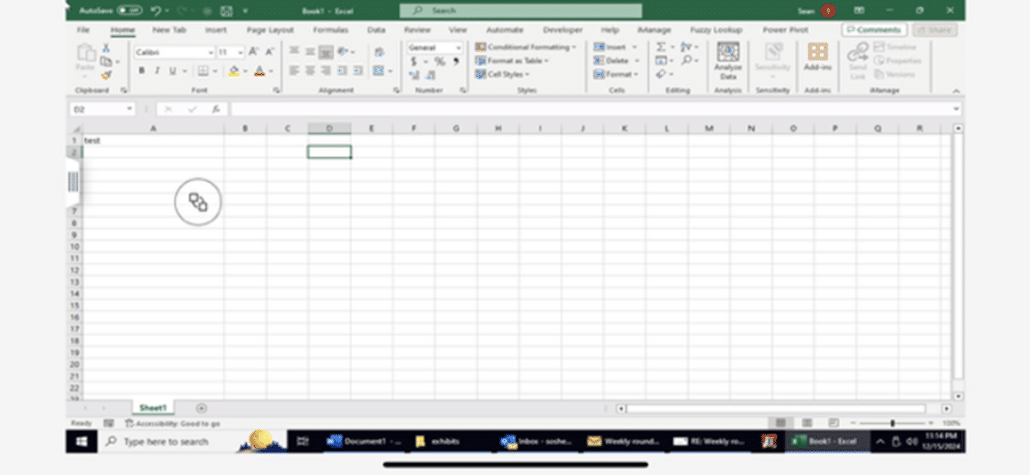

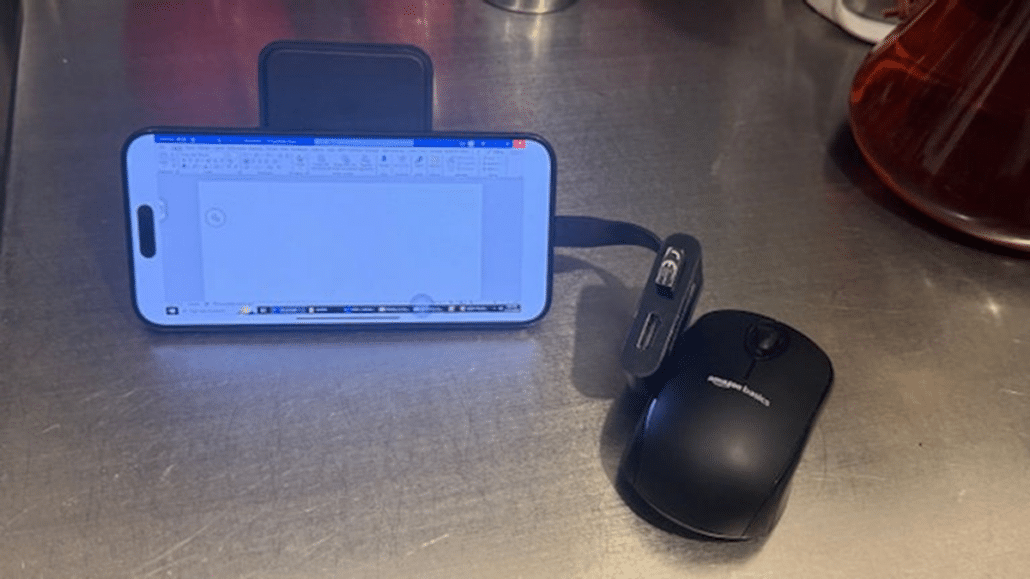

If your firm uses VMware to access a virtual desktop, don’t miss that you can install an app for VMware on an Apple iPhone. I’ve tested the app, and it allows you to work on your desktop with about three-quarters of the efficiency of working on a laptop or desktop computer – provided you can connect a mouse to your iPhone—which is what makes all the difference.

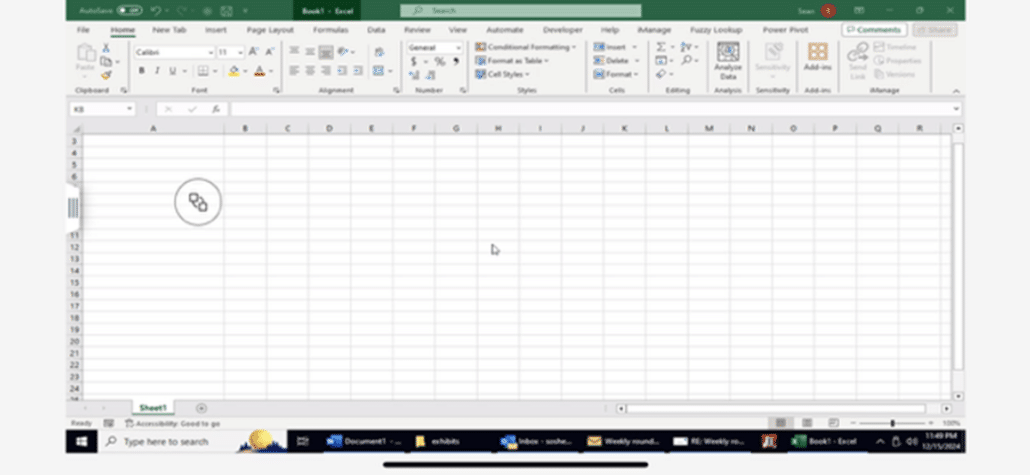

The app will load your desktop, and the appearance will be quite the same as you see on a PC – even if admittedly you’ll need to squint a little if you want to keep the same aspect ratio.

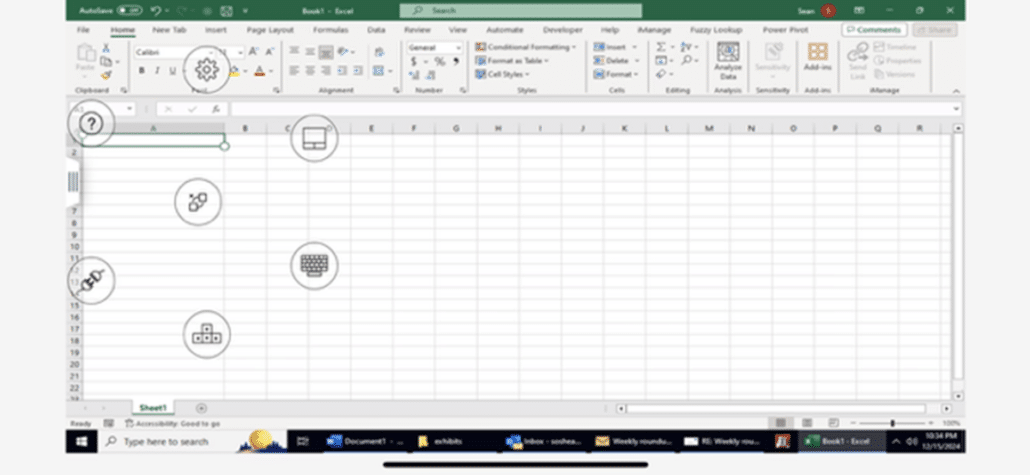

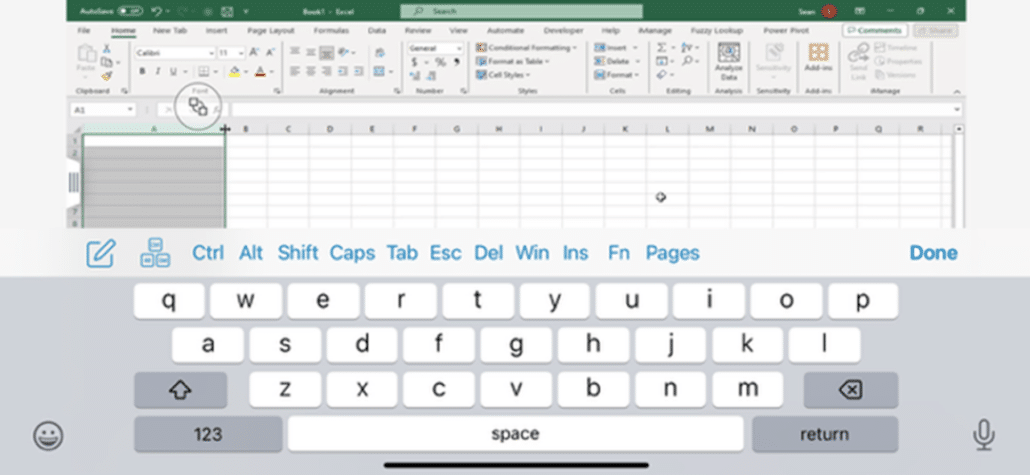

On the screen, you’ll see an icon that allows you to access the usual controls you’d use on a PC:

Click the ‘paired square’ icon, and bring up six additional icons which will let you access the keyboard; up, down, left, & right arrows; settings; gesture help; and the option to disconnect from VMware.

The VMware Horizon app will move in and out of portrait and landscape mode quite smoothly. But, in order to really avoid having your flow of work compromised you’ll need to pair a mouse with your iPhone. There’s more than one way to do this, but if the mouse you are using has a USB-A receiver, and you have a USB-A to USB-C adapter, you can connect the mouse like this:

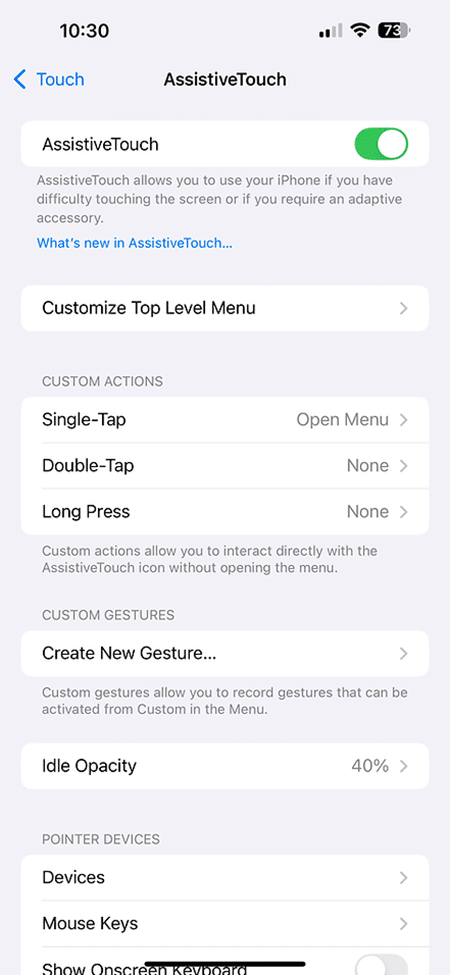

In order to enable the mouse on the iPhone, you’ll need to enable AssistiveTouch:

The mouse should then work – a cursor will appear on the iPhone you’re used to controlling with a fingertip.

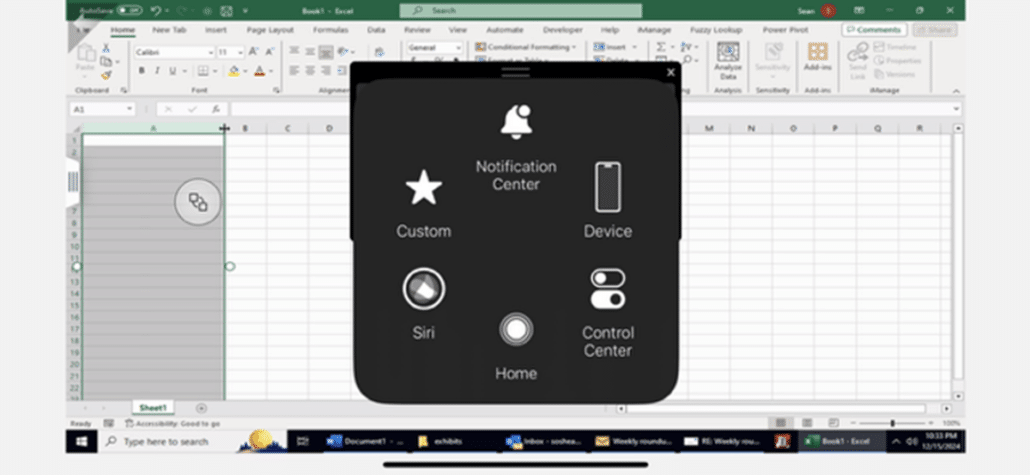

If you click on the fuzzy circle assistive touch option it will give you the option to go back to the home screen of the iPhone, or switch between apps.

If you really want to have the option to jump on VMware on the go, without lugging around a laptop, this is way to do it—though you may want to invest in a portable Bluetooth enabled keyboard as well.

Keep in mind that if the USB-A to USA-C adapter has a HDMI port as well, you’ll also be able to connect to a monitor that may be around and increase your level of workflow efficiency even more.

12/17/2024: Extracting Text Around a String in Excel

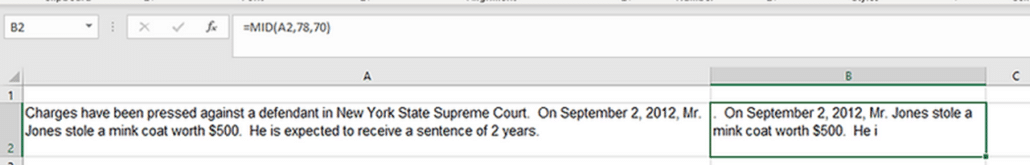

If you need to extract text from an Excel cell which is X number of characters before and Y number of characters after a given search term, you can use the MID and MAX formulas with a nested SEARCH formula.

A formula in this format:

=MID(A2,MAX(SEARCH(“stole a”,A2)-35,1),70)

. . . can be set to return the number of characters before the search string equal to the value given in the MAX formula (in this example 35) and the number of characters from the start of the search string moving to the right equal to roughly half the value given for the MID formula (in this example 70).

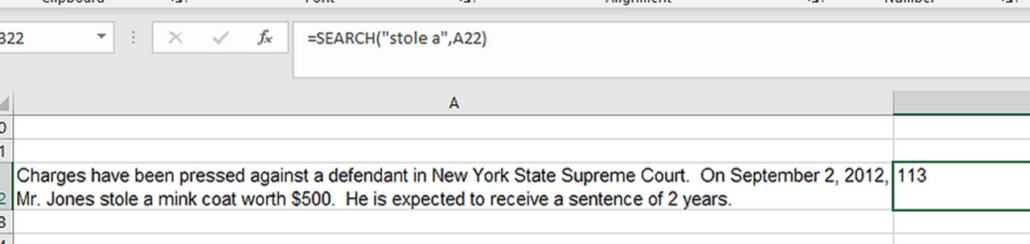

. . . the SEARCH formula finds the position in the cell containing text where the first character of the search term appears.

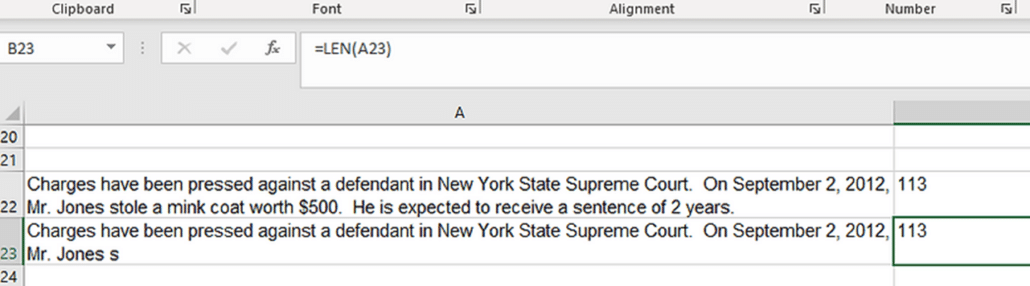

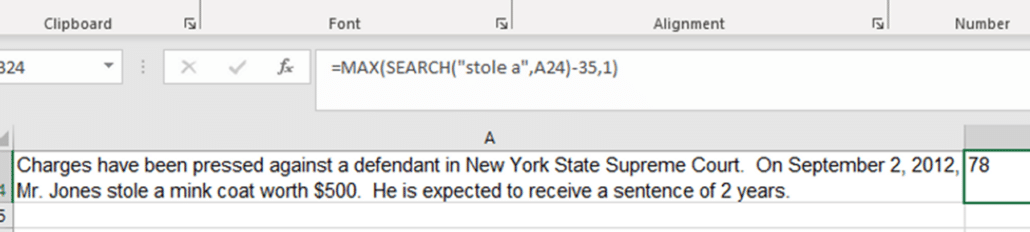

The MAX formula then gets the value of the SEARCH result minus the number entered in the complete formula. In this it is case 35.

When the result from the MAX formula is fed into the MID formula, it is used to determine the position where the extraction should begin, and how many characters after that point it should include.

12/31/2024: District of Nebraska on the Taxation of Costs

The United States District Court for the District of Nebraska has published a guide on how to prepare a bill of costs under 28 U.S.C. § 1920, which allows a party who gets a verdict in their favor to be reimbursed for certain costs by the losing party. It’s dated January 2020, and is available at: https://www.ned.uscourts.gov/internetDocs/info/taxation-of-costs.pdf . The Tip of the Night for May 6, 2021 discussed a Taxation of Costs guide prepared by the District of Massachusetts, and the Tip of the Night for June 21, 2021 reviewed one posted by the Eastern District of Washington. These are some key points in the Nebraska guide you will not find repeated in every discussion of the taxation of costs.

On page 7 the guide states that, “Electronic media support fees produced solely for the convenience of counsel (e.g., ASCII expenses, costs of realtime transcripts, condensed transcripts, scanning and hyperlinking, and rough drafts)” . . . may not be taxed. Some districts have different rules about reimbursement for realtime fees. For example, a guide on the taxation of costs prepared the District of South Dakota states that, “[t]he requesting party must provide an explanation as to why it was

necessary to have any transcript produced in an expedited manner, including Realtime trial/hearing transcript feeds.”, even though it too instructs that, “[c]osts of expedited transcripts produced solely for the convenience of counsel” may not be taxed.

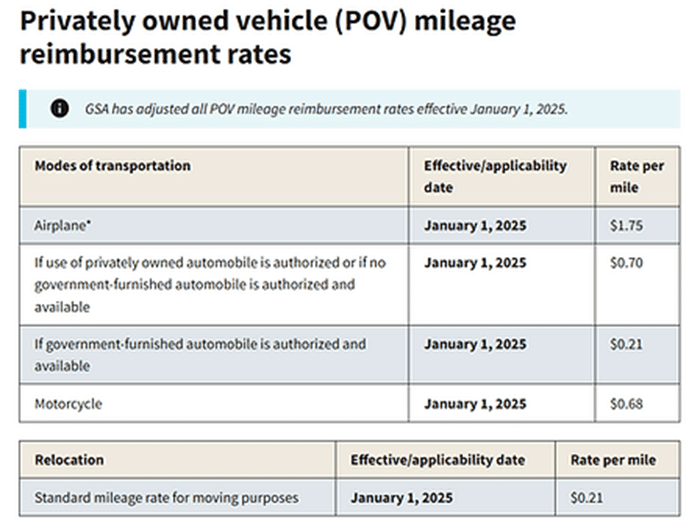

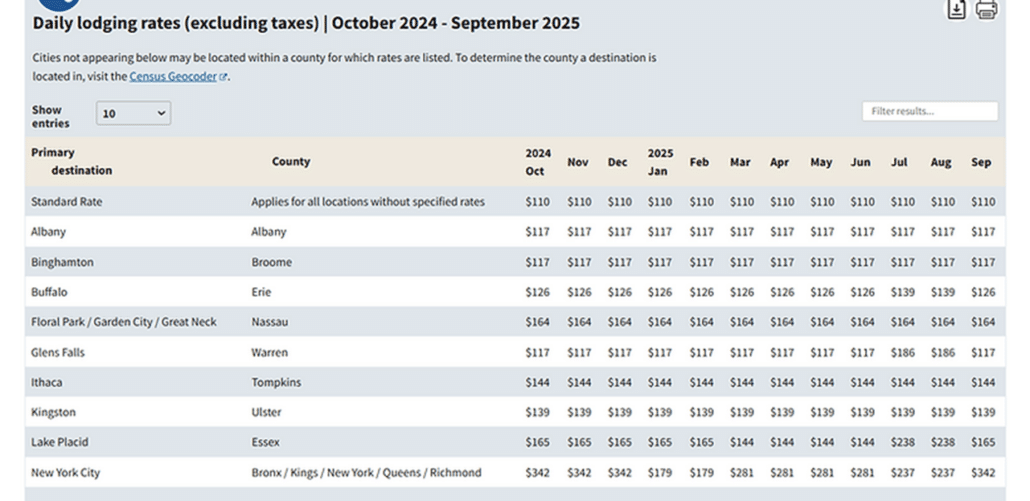

The Nebraska guide instructs that in compensating for a witness’s travel expenses, the prevailing party should refer to rates listed at www.gsa.gov/mileage when the witness uses his or her own vehicle for a trip, and to www.gsa.gov/perdiem for the maximum that may be charged for a ‘subsistence allowance’ when the witness has an overnight stay for a trial. A witness driving a car to a courthouse is reimbursed at a rate of 70 cents per mile as of January 1, 2025. Surprisingly rates are listed for trips made by privately owned airplanes and motorcycles as well!

A witness who takes a commercial flight, or a train trip, must “utilize a common carrier at the most economical rate reasonably available”. While the guide doesn’t refer to it, note that the General Services Administration has another page, https://www.gsa.gov/travel/plan-a-trip/transportation-airfare-rates-pov-rates-etc/airfare-rates-city-pair-program, on which it lets you search for the cost of a flight between any two cities, but also note that these prices may be lower than a witness can obtain because the government contracts for discounted fares.

The per diem costs may vary widely depending on what city a witness stays in, and at what time of year. $342 in New York City in December, but only $165 in Lake Placid at the same time, but $238 in Lake Placid, and actually one dollar cheaper in New York City in July.

The guide states that the clerk will not tax, “Routine expenses for copies made for discovery purposes, including discovery costs associated with scanning or converting ESI to a useable format.” This differs from the decision in Johns Manville Corp. v. Knauf Insulation, LLC, 15-cv-00531-RBJ-KLM, 2018 U.S. Dist. LEXIS 88189 (D. Colo. May 25, 2018), in which the District of Colorado held that § 1920(4) should cover the costs of scanning and conversion to the TIFF and PDF image formats, following the Third Circuit precedent in Race Tires Amer., Inc. v. Hoosier Racing Tire, Corp., 674 F.3d 158 (3d Cir. 2012). See the Tip of the Night for May 29, 2018.