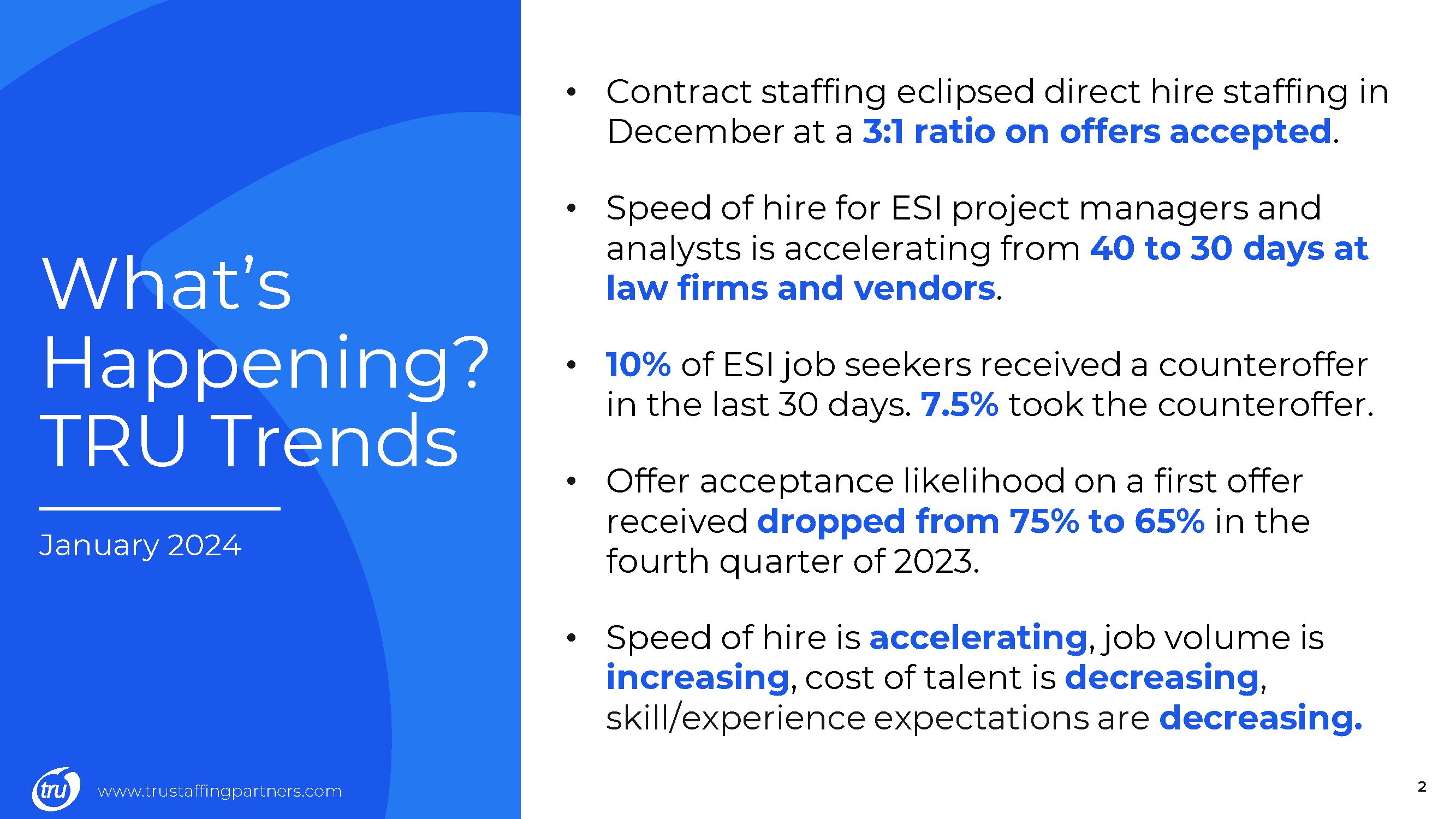

Opportunities in the ESI job market are abundant despite employers being cautious about the economy. As discussed in the January edition of Eye on ESI, volume for job seekers is high if you know where to look. Here is the overview slide of what occurred last month and is a precursor to what we are seeing in Q1 of 2024:

We are tracking a number of trends. First, contract staff hiring is flourishing for all types of ESI roles in both law firms and vendor organizations. During our last webinar in December, we discussed how aggressive the contract market was, and we are seeing it continue into 2024. At the end of 2023, the contract job market overtook direct hiring at a three-to-one ratio at the point of hire. That’s a very dominant statistic for this industry. Contract staffers fill a number of key billable roles for TRU clients including holiday coverage, beginning-of-the-year hiring gaps, and TRU contractors are experienced pros who are plug ‘n play – ready to be billable on day one.

The second trend we are closely watching is the speed of hire in the industry. During the pandemic, hiring occurred at warp speed, then things calmed to a stately 40 days from search beginnings to offers being placed. That has dropped again to 30 days for both law firms and vendors who don’t want to miss out on the best candidates in the marketplace. This means that hiring managers are making decisions faster on mid-market hires at both law firms and vendors. It is unusual to see law firms move at the same pace as vendors, but they need to because candidates are receiving multiple offers as well as counteroffers.

Third, in a surprising move, counteroffers seem to have returned to the ESI marketplace, and that is not a good thing for anyone. If you attended our Eye on ESI last month, you may remember that TRU had not had anyone receive a counteroffer, much less accept one, in more than 170 days. That record was broken in December and more than 10% of the TRU candidates we represented for roles received counteroffers. Some of those folks took those offers and it remains to be seen whether they will stay in their present roles or go back to market. Anyone who has collaborated with TRU knows that you should never accept a counteroffer. Counteroffers are Band-Aids that temporarily smooth over much larger problems. Most who accept these offers quickly return to job searches because their underlying reasons for looking in the first place have not been addressed.

It’s important to begin any job search by being prepared to know what you want. This includes the reasons you are leaving a role, reasons for searching out a new role and deciding what you ultimately want to do with your career. We ask all of our TRU candidates what they want from a new role. And if they like their jobs but want more money, we coach them on how to approach their bosses for a raise or a promotion.

The fourth bullet is also a significant change from Q1 of 2023. Accepting first offers was very commonplace after the pandemic. People were grateful to have them and jumped at most first offers. Now, because they are receiving multiple offers and the speed of hire is accelerating, only 65% of TRU candidates are taking their first offers. However, as a point of contrast in 2022, there were SO many offers flying around that this stat was about 40-45%.

The last point on this slide shows an industry shift. The speed of hire is increasing, the job volume is increasing, the cost of talent is decreasing, and skill experience expectations are decreasing. This is a significant change from the past years during The Great Resignation where two-thirds of the ESI industry changed jobs. Law firms and vendors were looking for experienced workhorses to drive revenue and get the work done. Now, hiring managers want less expensive, less experienced people because they need to increase their margins because they cannot raise their prices. Therefore, there will be a lot of job opportunities for people earning less than a $150k base salary level. The volume is very high right now and there are not a lot of candidates filling those roles.

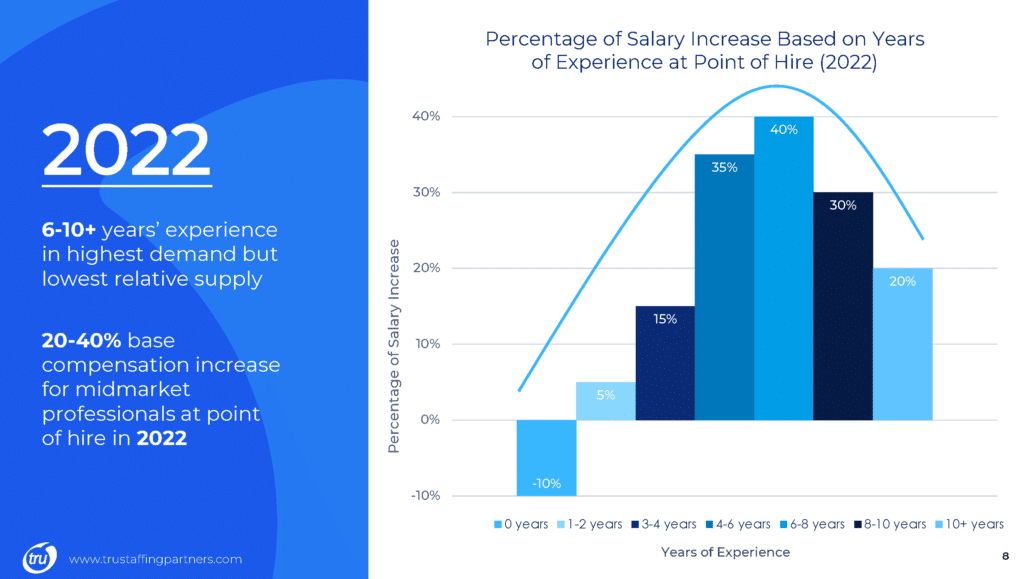

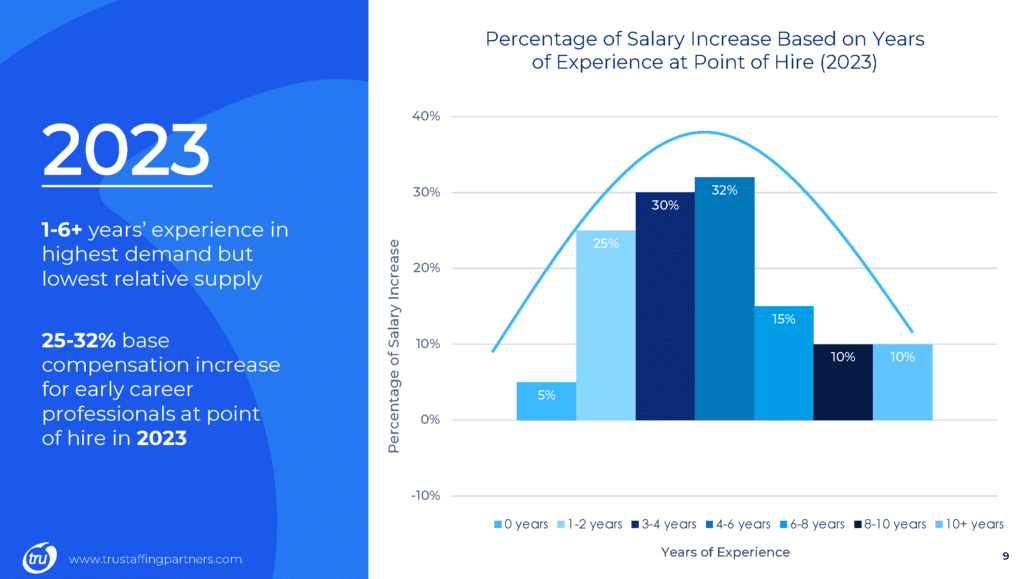

See the salary differences on the next two slides:

In 2022, mid-market ESI pros (5 to 10 years) could command a much higher bump when changing jobs. These pros were in the highest demand and were in the lowest supply since everyone wanted them and would give them almost anything. However, this all changed in 2023 where the industry is open to early-career pros looking for new roles. Hiring managers are now ready to train newbies to become project managers and analysts, in-office requirements are minimal and opportunities for growth are tremendous.

There is much curiosity about what the market looks like and where it will be headed in 2024. For that reason, TRU Staffing Partners has created the definitive 2024 eDiscovery Jobs Report, which we will launch at LegalWeek 2024. We cover every ESI job market statistic available, based both on nationally published data and our own research into this close-knit industry. Both job seekers and hiring managers will find it valuable to know the state of the industry, how it will change this year, and what to expect as the year progresses.

For example, while we expect employers to be cautious about full-time hiring for the first two-quarters of this year and to instead rely on contract workers to get the work done, TRU predicts a huge hiring surge in the second half of 2024. Interest rates should be lower, candidates will be plentiful, and litigation will surge, requiring more talent on deck.

No matter how well you think you know the ESI market and where it will go, you need expert advice in these challenging times. Don’t try to get the new role or hire industry professionals without an agent. TRU Staffing Partners will help you find the best possible option for your career or hiring needs. Contact us for representation or to start your hiring process today.