Good news travels fast, and for the attendees of the January 2023 episode of Eye on ESI held on LinkedIn Live recently, many thumbs up flew across the screen, despite lingering fears of a recession. For this session, I was again joined by ACEDS speakers Michael Quartararo and Maribel Rivera to help share the newest data on the ediscovery industry.

Speed of Hire Slows for Law Firms

I think the speed of hire is probably the most dynamic variable that’s changed in the job market since the COVID-19 pandemic. What we don’t have on this chart are the variable numbers for timing prior to 2021. But as you can imagine, they were a lot slower than what you see here in 2021, which is really the peak of the speed of the market post-pandemic.

As we went into 2022, things have slowed down a little bit. But if we really look at what’s changed since the second half of 2022, you’ll see a difference in mid-market law firm hiring for ediscovery. Law firms are moving more than 30 days slower than they were at the end of last year. They’re trying to bring people back into an office and they’re holding tight on a three-day-a-week in-office commitment. The difference between asking people to come in three days a week versus two days a week increases your talent pool if you’re a hiring manager in ediscovery by almost 50 to 60%. As soon as you drop down to two days, people are much more willing to consider that.

Vendors are still hiring PMs, analysts, analytics, and forensics professionals in about 25 to 35 days. And that hasn’t changed. The main reason for this is because those jobs are still fully remote.

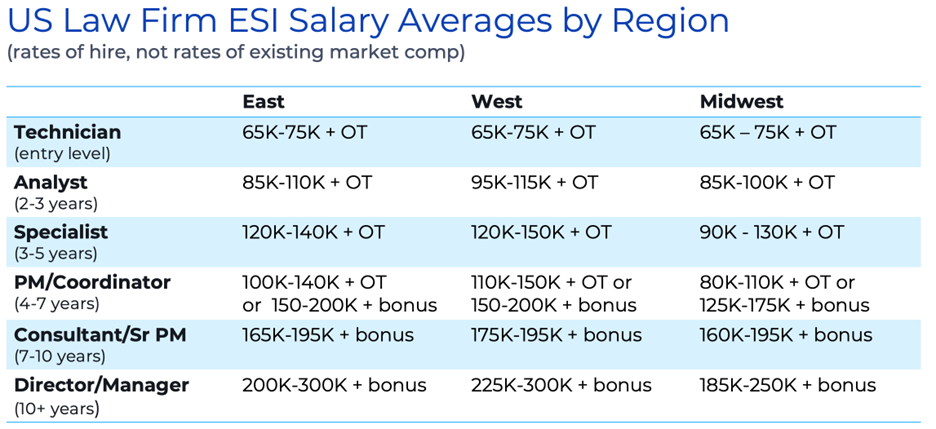

Law Firm Salaries Hold Firm by Region

If you want to work at a law firm and you’re willing to go into an office three days a week or more, you have a real opportunity to continue to make the kind of increases in compensation that people have been making for the last two years, because that hasn’t changed. Executive search is taking longer, but we think that has more to do with holiday preparation and the switchover from annualized fiscal years. We think it’ll go back to about a four-to-eight-week cycle.

The numbers are strong, but that’s good news because you would think, with the culture that we see in the bigger community, that we’d see law firms wanting to pay less. However, they’re happy to pay what the new market standard is.Money has not been the challenge in filling these jobs. Filling them in the specific geographies with in-office requirements has been the challenge. So, again, if you’re somebody that’s willing to go into an office, particularly in a large urban area – get in touch, because there’s a lot of opportunity. We are seeing people make 40-50% increases in salary, going from a $120k base to $165k, $170k in base, moving from a vendor to a law firm if you are willing to go into an office.

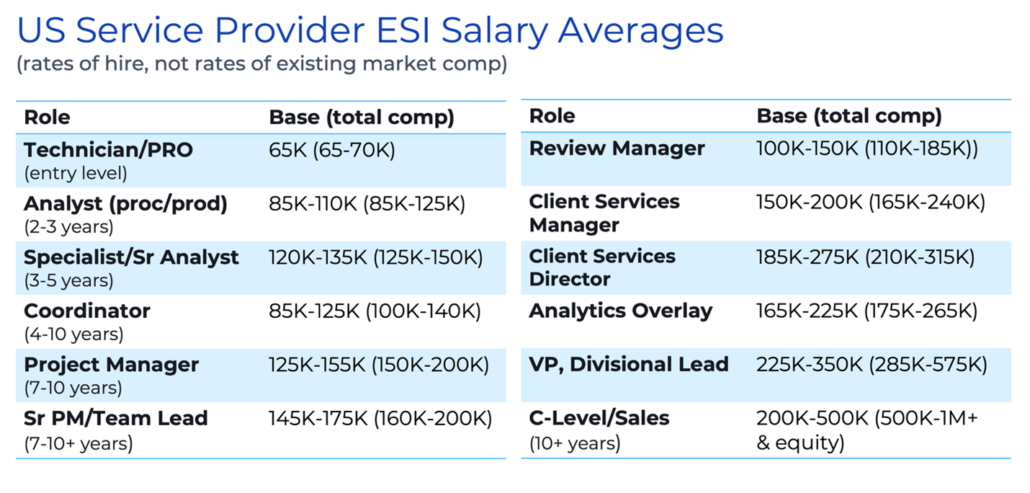

Service Provider Salary Bumps Are Seen for Entry-Level Hires; Talent Development Programs are Effective

Salaries with service providers have not changed much, but I want to highlight this because we’ve seen a lot of entry-level placements in this area in the last six weeks, and the salary levels have climbed to $65k. We’re seeing people that are in IT or forensics moving into ediscovery. We see people with bachelor’s degrees in technology and computer science finding their way into this industry. These numbers are what the market accepts.

It is very clear what employers want from these entry-level ediscovery techs. They now have a process in place for grooming these folks into project management. We’re starting to see the actual formalization of talent development programs – farming systems if you will – for the first time in a decade. Because the job market tanked in the fourth quarter of last year, and salaries were so highly inflated, it encouraged more than a handful of ediscovery vendors to groom the next generation.

Also some news: TRU will be offering an internship with a vendor for the first time soon, as part of our annual scholarship program. This program will allow someone to come in and get on-the-job paid training. It will draw augment all the great scholarships that we have, including ACEDS, which gives a very generous scholarship to our applicants every year.

The first thing new-to-ESI job-seekers need to do to break into the industry is self-invest. And the people who’ve got their certifications and have never had a chance to apply that knowledge are definitely getting preferential treatment when put up against six other people that may have superior technical skills. These certifications signal to an employer that this is somebody worthy of making an investment in because they’ve already invested in themselves.

The slide above also shows a change in the sales salary level. This dropped down from an average of $250K for base compensation for a sales rep selling more than $4 million a year in revenue, to $200k. And we are seeing employers offer fewer equity opportunities and demanding more proof of ability. I don’t think you’re going to see as generous packages in 2023 for sales reps changing jobs as you did in 2021 and 2022. Having said that, if you are someone that is really on the exceptional track, say you’re doing more than $5M a year: An employer will give you a fantastic offer to make a move if you’re ready to commit.

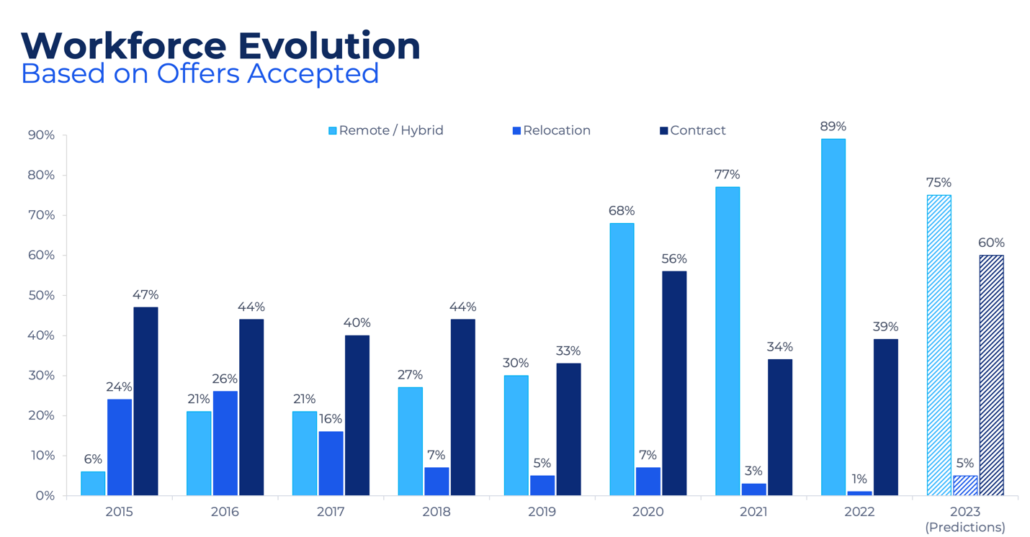

Workforce Evolution Swings Toward Contractors

In 2022, remote/hybrid workforce reached 89% in ediscovery. And two-thirds of that 89% were fully remote. Because of all the remote work, you’ll see that relocation was at 1% last year. We predict relocation will go up because we’re seeing law firms starting to be open-minded to people relocating to cities like New York and San Francisco to get them into an office. So we anticipate that 1% will climb to 5%.

When it comes to contracting, this is probably the most important swing. As you could see in 2019, it was at 39%. Then during the pandemic, the market swung almost fully to contract at 56%. Then it bottomed out again in 2021, when full-time hiring exploded in the first three quarters. The contract business for TRU and for the market ended in 2022 at 39%. That 39% is not indicative of a whole year. That 5% jump is indicative of a radical shift in the fourth quarter.

We think by the end of this year, contracting is going to be close to 60% of the ediscovery marketplace. Because either law firms or candidates will bend on their in-office/remote requirements. I don’t see either of those things happening. So we’re at a stalemate, which is why the timeline for hiring is extended by 30 days for law firms. Law firms may need to either hire and relocate people or hire contractors and then let them work remotely.

In the US broadly right now, at least 35% of workers are contractors, which is more than one out of every three people. In ediscovery, last year it was 39%. That’s the percentage of job orders we filled compared to full-time jobs. It’s almost 40 percent of the marketplace. And we think by 2024, it will stay at 40% because the market’s going to stabilize.

But you can see the swing of how things change in our industry. This is how the market is behaving. What employers can do to compete more effectively is consider contractors for short-term contracts. The available talent pool is not just out of work people. It’s people who are hitting the ceiling of their ediscovery careers and not wanting to be full-time employees.

Now’s also a great time to be looking for a job. People are eager. People want to move fast. Ediscovery is a great community and a great industry, and I really am proud to be part of it and really glad to kick off the new year with all of you. Check out the open ediscovery positions on the TRU Staffing Partners website for more information!